boulder co sales tax 2020

Longmont Sales Tax Division 350 Kimbark St Longmont CO 80501. The citys Sales Use Tax team manages business licensing sales tax use and other tax filings construction use tax reconciliation returns and various tax auditing functions.

Construction Use Tax City Of Boulder

Return the completed form in person 8-5 M-F or by mail.

. The County sales tax rate is. The Henderson County Tax Collectors Office can no longer take payments under the new Tag and Tax Program. - Hay for sale- Round Bales.

Boulder County CO Sales Tax Rate The current total local sales tax rate in Boulder County CO is 4985. The current total local sales tax rate in Boulder County CO is 4985. Businesses located in the Centerra Fee districts sales tax rate is 175 and is in addition to the district fees.

The City of Lovelands sales tax rate is 30 combined with Larimer Counties 080 sales tax rate and the State of Colorados 29 sales tax rate the overall total is 670. Sep 28 2020 A Nevada Department of Motor Vehicles DMV location in Las Vegas on June 23 2020. Hay for sale Round and Square Bales and.

For tax rates in other cities see Colorado sales taxes by city and county. The Colorado sales tax rate is currently. The Colorado state sales tax rate is currently 29.

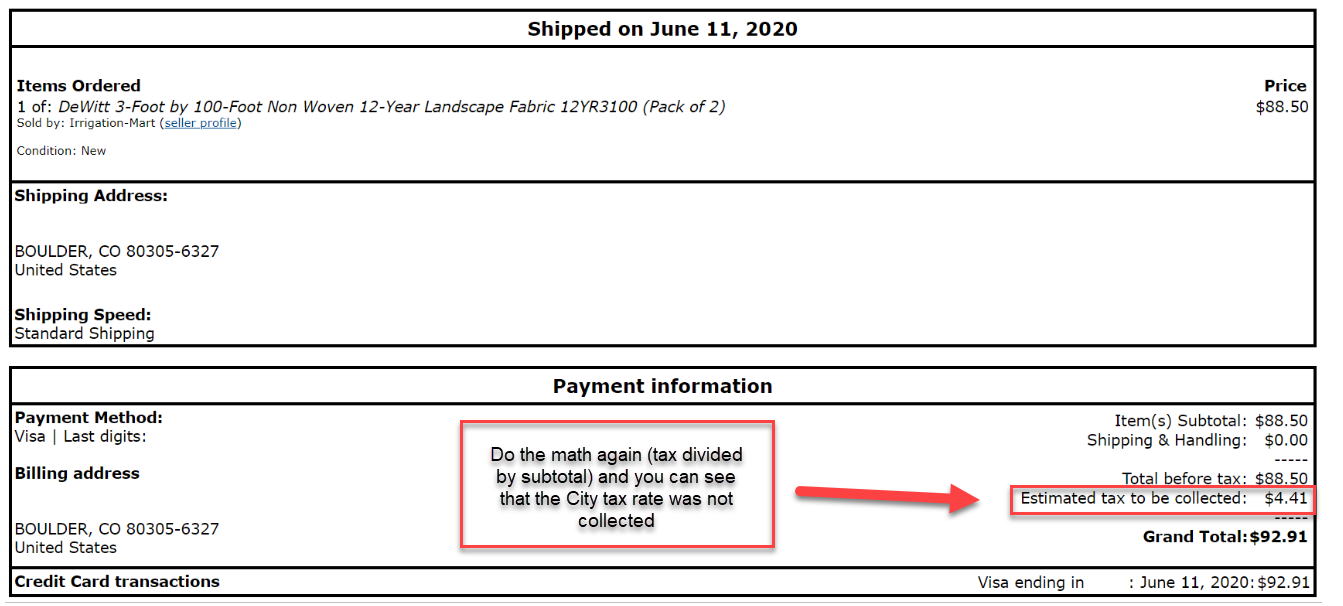

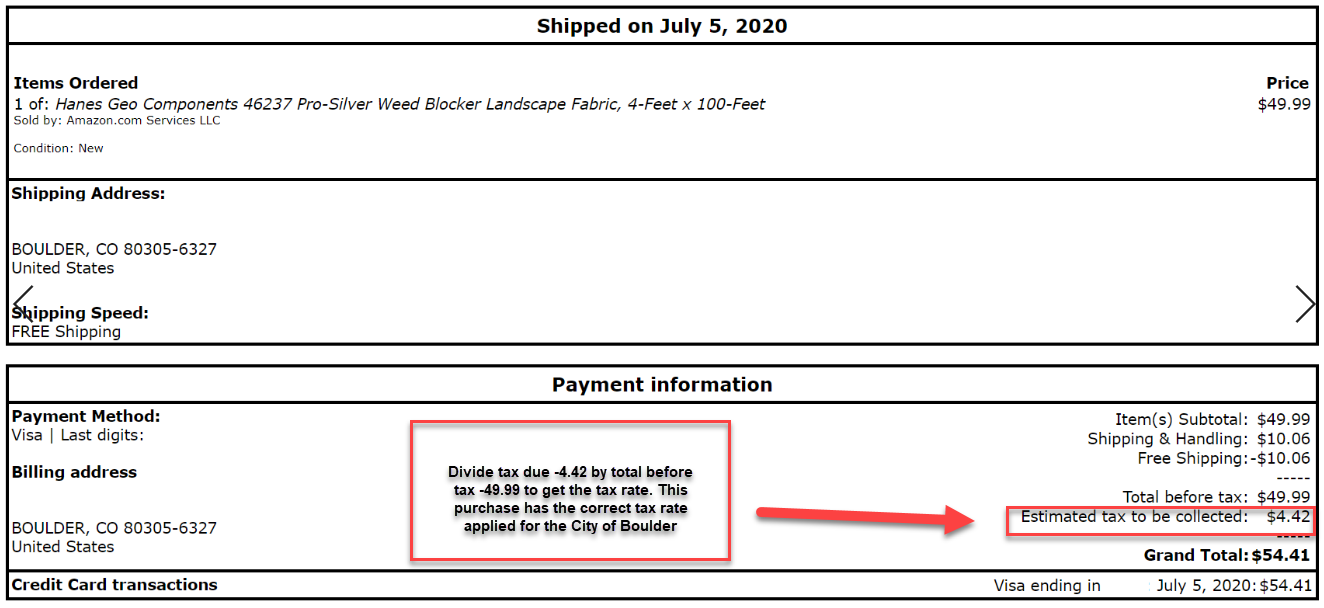

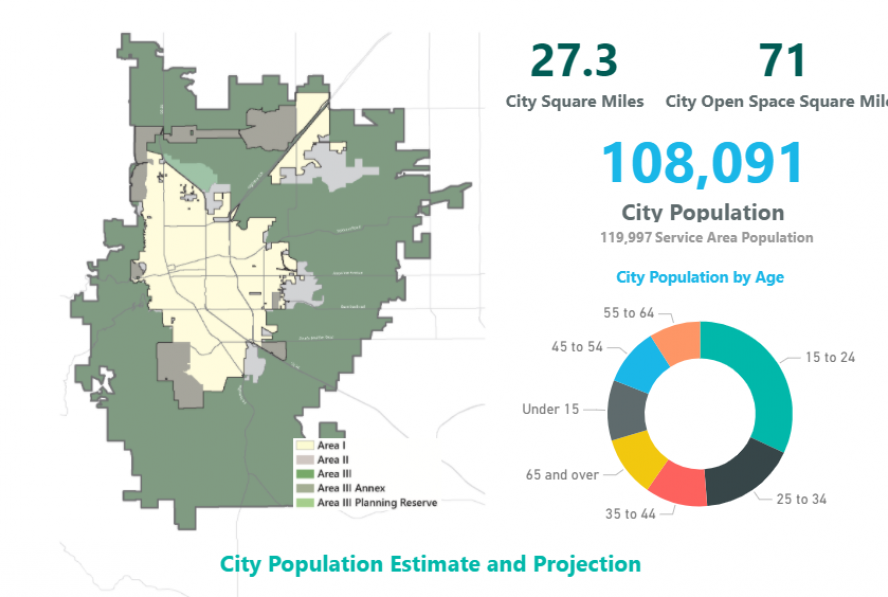

Sales tax is due on all retail transactions in addition to any applicable city and state taxes. The Boulder Colorado sales tax is 885 consisting of 290 Colorado state sales tax and 595 Boulder local sales taxesThe local sales tax consists of a 099 county sales tax a 386 city sales tax and a 110 special district sales tax used to fund transportation districts local attractions etc. August 5 2020 51240000 Series 2020 Tax-Exempt Fixed Rate Bonds Objectives Given favorable market conditions Boulder aimed to take advantage of low interest rates to convert intermediate debt to long-term fixed reimburse itself for prior capital expenditures and remediate a portion of existing debt used to finance assets at risk of.

YTD December 2020 sales tax including audit revenue declined by 9458832 or 833 when compared to YTD December 2019. CO Sales Tax Rate. The 2018 United States Supreme Court decision in South Dakota v.

Did South Dakota v. This table shows the total sales tax rates for all cities and towns in. The rate is comprised of individual voterapproved county sales and use tax ballot measures adopted to support county programs in conservaon transportaon offe nder management nonprofit capital.

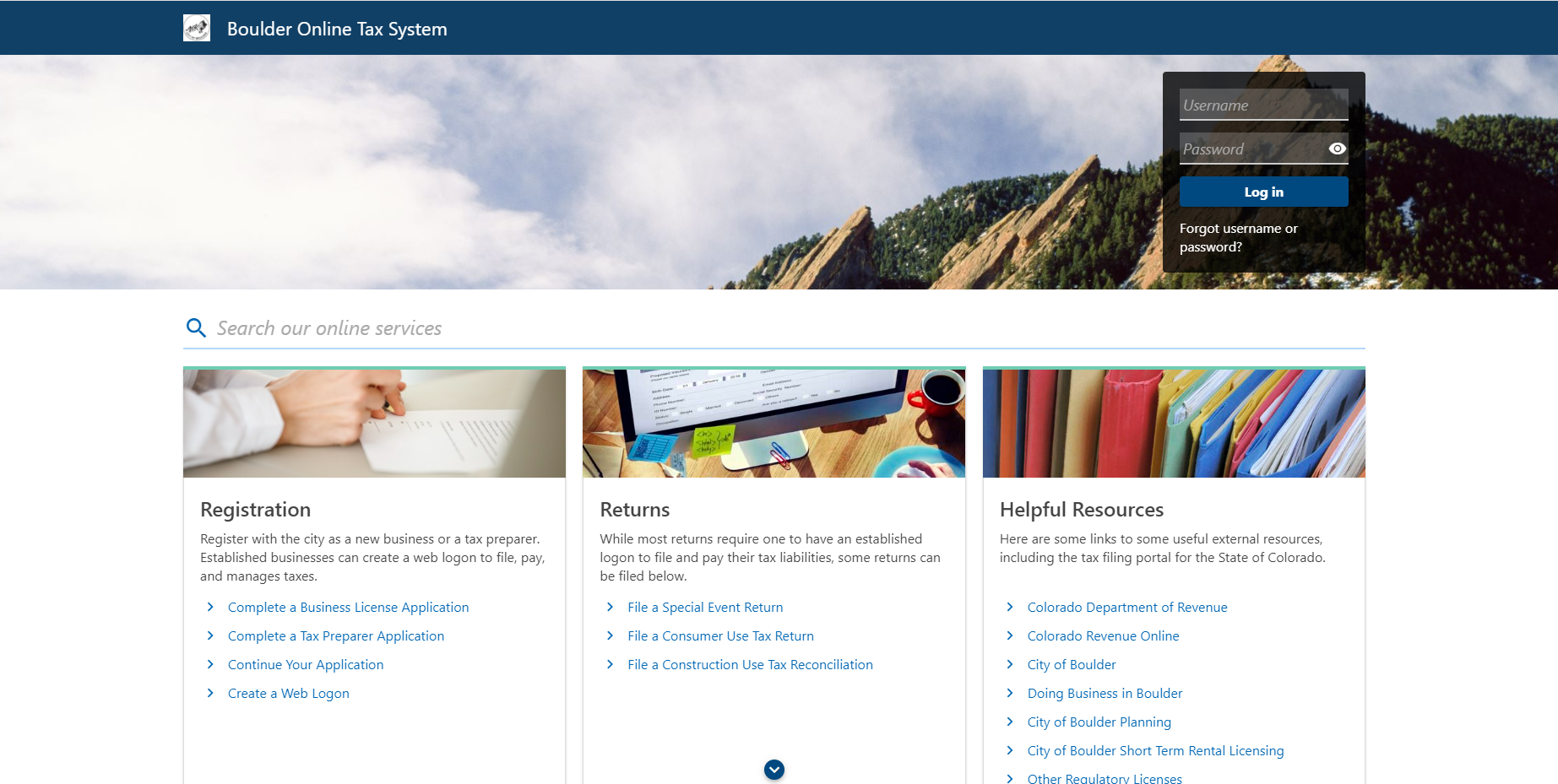

All applications submitted in completion with all necessary documentation will be equally evaluated by Colorado Enterprise Fund staff and a local review panel. Boulder County does not issue licenses for sales tax as the county sales tax is collected by the Colorado Department of Revenue CDOR. The 2020 Boulder County sales and use tax rate is 0985.

How to Apply for a Sales and Use Tax License. The Boulder County sales tax rate is 099. Boulder County 0985 TOTAL Combined Sales Tax Rate in Longmont.

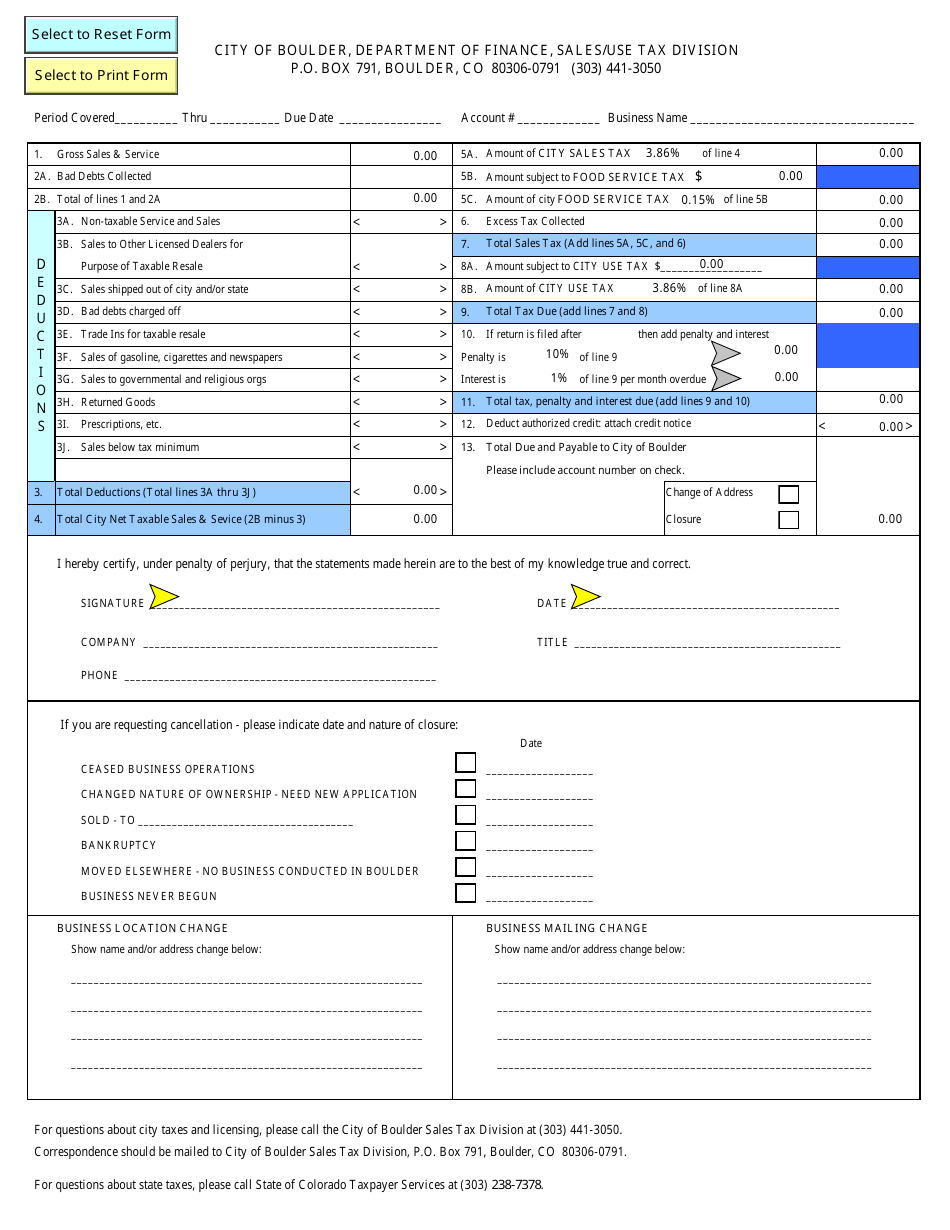

The Boulder Sales Tax is collected by the merchant on all qualifying sales. Current City of Boulder use tax rate is 386. The minimum combined 2022 sales tax rate for Boulder Colorado is.

December activity reflects severe public health restrictions after Boulder County moved to Level Red on November 20. February 2020 retail sales tax revenue was down 12 compared to February 2019 revenue including audit revenue and the additional recreational marijuana sales tax. The December 2020 total local sales tax rate was also 4985.

This document lists the sales and use tax rates for all Colorado cities counties and special. 00 tax per bale Feb 18 2014 Horse quality grass hay for sale barn stored Boulder -. The 8845 sales tax rate in Boulder consists of 29 Colorado state sales tax 0985 Boulder County sales tax 386 Boulder tax and 11 Special tax.

Salestaxbouldercoloradogov o llamarnos a 303-441-4425. The 2020 Boulder County sales and use tax rate is 0985. LID sales tax is remitted in the cityLID column on the DR 0100 Retail Sales Tax Return Use tax is not applicable.

Para asistencia en español favor de mandarnos un email a. 3 hours agoField ready. Dmv services las vegas.

Boulder county cip - 2007 sales tax current phasing plan current roadshoulder safety projects estimated timeline projects requiring action by project partner projects requiring planning pre-engineering draft boulder county transportation march 2020 - draft page 1 of 2. Exemptions areTelephone and telegraph service gas and electricity for residential and commercial use. The Boulder sales tax rate is.

Month-Over-Month Change in Retail Taxable Sales. 2055 lower than the maximum sales tax in CO. This is the total of state county and city sales tax rates.

The Colorado sales tax rate is currently. Total Sales and Use Tax 68246280 61907117 6339163 929 492 Revenue Trends and Changes During June 2020 most retail establishments were open some or most with reduced hours or capacity. About City of Boulders Sales and Use Tax.

The fertile valley rests at 5800 feet creating an optimum growing season for high quality Timothy Alfalfa Hay products. Has impacted many state nexus laws and sales tax collection. This is the total of state and county sales tax rates.

Colorado has a 29 sales tax and Boulder County collects an additional 0985 so the minimum sales tax rate in Boulder County is 3885 not including any city or special district taxes. The total sales tax rate in any given location can be broken down into state county city and special district rates. The Boulder Small Business Grant Program is a competitive application process.

The city of boulder will no longer mail returns after jan. The minimum combined 2022 sales tax rate for Boulder County Colorado is 499. 2 hours agoHome About Us DMV Forms Driving Manuals Drivers License Site Map.

Boulder Countys Sales Tax Rate is 0985 for 2020. The December 2020 total local sales tax rate was 8845. LID Boundaries Sales Tax Rate Service Fee Allowed Boulder County Old Town Niwot and Cottonwood Square 1 0.

Applications will be accepted August 31 2020 at 800 AM through September 11 2020 at 500 PM. You can print a 8845 sales tax table here. CBS4 Beginning Wednesday all vaping products sold in Boulder will be subject to an additional city sales and use tax of 40Its part of an effort to curb use among young.

Bond Sale Date. The current total local sales tax rate in Boulder CO is 4985. Comparing activity for just the month of June June 2020 sales tax declined by 1352487 or -126 when compared to May 2019.

How Cu Boulder Is Funded Budget Fiscal Planning University Of Colorado Boulder

Short Term Dwelling And Vacation Rental Licensing Boulder County

Moving To Boulder Boulder Co Relocation Homebuyer Guide

733 Lakeshore Dr Boulder Co 80302 4 Beds 2 5 Baths House Inspiration Home Bouldering

City Of Boulder Colorado Sales Use Tax Return Form Download Fillable Pdf Templateroller

How Cu Boulder Is Funded Budget Fiscal Planning University Of Colorado Boulder

Boulder Cost Of Living Boulder Co Living Expenses Guide

Sales And Use Tax City Of Boulder

Boulder Colorado Co Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Summerlin A Master Planned Community In Las Vegas Nv Amenities Maps Community Master Planned Community How To Plan Las Vegas

Cience Debuts At 31 In The Financial Times Americas Fastest Growing Companies 2020 Send2press Newswire Financial Times How To Start Conversations Financial

Taxes In Boulder The State Of Colorado

2515 Boulder Rd Altadena Ca 91001 Mls P1 4307 Redfin Bouldering House Styles Exterior

Innovation Technology City Of Boulder

Http Www Fullersothebysrealty Com Eng Sales Detail 218 L 868 Wpp6wg 1538 75th Street Boulder Co 80303 Luxury Swimming Pools Indoor Outdoor Pool Dream Pools